Hey Everyone!

This is your Hard Money Lender in Tucson and the Southern Arizona area, Billy A. I found this informative article that made the headlines today on MarketWatch.com I’d like to share here with you:

Housing Not ‘Out of Woods’ Despite Improving Conditions

By Greg Robb, MarketWatch

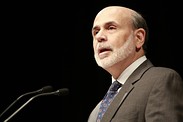

WASHINGTON (MarketWatch) — Mortgage lending standards now appear to be “overly tight,” and are preventing creditworthy borrowers from buying homes, Federal Reserve Board Chairman Ben Bernanke said Thursday. Some tightening of credit standards was appropriate to the lax lending conditions that led up to the housing bubble, he said.

“However, it seems likely at this point that the pendulum has swung too far the other way, and that overly tight lending standards may now be preventing creditworthy borrowers from buying homes, thereby slowing the revival in housing and impeding the economic recovery,” Bernanke said. Read full speech.

Fed officials have been outspoken about the need for government policy to help the market for single-family homes. This view has brought the Fed into a clash with congressional Republicans, who have argued that market forces should be allowed to work. Prices have dropped by about a third since the housing bubble burst, but have started to come up. But construction activity, home sales and home prices remain much lower than they were before the crisis.

In September, the Fed embarked on a unprecedented buying of mortgage-backed securities as mortgage rates have been hovering around record lows. The Fed is buying $40 billion of MBS per month with no end-date, saying only that the purchases would continue until there was substantial improvement in the labor market.

Overall, Bernanke said there are now “welcome signs” of an emerging improvement in the housing market in most parts of the country. But he quickly added that it was not enough.

“We should not be satisfied with the progress we have seen so far,” Bernanke said. “The housing sector is far from being out of the woods,” he added.

Bernanke did not offer any solution to the tight standards. In general, he said that policymakers must continue to look for ways to strengthen the recovery in housing. The Fed’s survey of senior loan officers shows that lenders began tightening mortgage credit standards in 2007 and “have not significantly eased standards since,” Bernanke said.

The latest survey released late last month showed that banks were not making it easier to get a mortgage even though interest rates were at record lows, housing prices are starting to creep higher and foreclosures have dropped. Bernanke’s remarks came in a speech to a conference in Atlanta sponsored by Operation Hope, an economic empowerment organization.

The extension of mortgages to homeowners fell by more than half from 2006 to 2011 and now stands at the lowest level since 1995, Bernanke said. Lower-income and minority communities were disproportionately affected by the housing bust, Bernanke said. Most of the hard-won gains made by low-income and minority communities in the past 15 years or so have been reversed, he said. The home ownership rate for African Americans fell 5 percentage points from 2004 to 2012, compared with about 2 percentage points for other groups.

********

Well at least they’re talking about the issue. That’s a good thing, right? That’s it for this time! Make it another great day!

Your Hard Money Lender in Tucson and Southern Arizona,

Billy A

P.S. I want to be your favorite Hard Money Lender in Tucson and Southern Arizona, so please don’t keep me a secret! If you, your friends or family need help with funding, I’d be happy to give them free information without any obligation. Please give me a call at:

(520) 299-4878!

Free Lunch and Learn Seminar – Tuesday, November 20th

Click image below for more details. I look forward to seeing you there!